While at the European Parliament the political group of the Greens hosted the ‘GM-free Europe’ event where policy makers and stakeholders from national and NGO organisations expressed worries around the possibility to a deregulation of ‘new GMOs’, the Commissioner for Health replied to the chair of the AGRI Committee saying that new technologies could be […]

Our Works

Establishment of a EUROPEAN FUND FOR THE MANAGEMENT OF CRISES IN AGRICULTURE

POLICY PAPER

November 2018

The CAP includes some provisions aimed at combating the crises that all too often strike the agricultural sectors.

Direct payments are a first layer of income stabilization, but they are not designed to respond to a sudden large-scale crisis, be it climate or market.

Since 2013, the CAP has also provided support for climate insurance and income stabilization instruments. It has to be said that their implementation has been very modest and uneven within the European Union. In the current budgetary framework only 380 million € a year is mobilized by the CAP to support risk management tools; ie less than 1% of the budget.

In 2018, the severe drought in many parts of Europe has shown how weak the sector is and how poorly prepared it is to deal with these extreme climatic events that are expected to increase. In a context where private insurance schemes remain rare, farmers are at the mercy of events and the willingness of national governments to provide exceptional assistance.

Once again in 2018, the drought was managed in a scattered order with state aid varying from country to country according to the intensity of the crisis, but also according to the budgetary capacity of the authorities and the media visibility of events – creating distortions of treatment between European farmers and a lack of objectivity in risk coverage. In total, some 800 million euros in emergency aid have been announced, mainly in Germany, Sweden, Poland, Finland and Ireland.

The dairy crisis of 2015/16 had for its part shown the extreme vulnerability of farms in the face of abrupt and profound market jumps, profoundly affecting farm margins and their ability to continue to project themselves.

Although a number of recent improvements have been introduced at EU level with the Omnibus Financial Package, the Commission’s proposals for the future do not seem up to the task of building an effective system of:

– risk management based on previous achievements

– and serious crisis management, essential relay for a development of the risk management at the initiative economic sectors in case of medium-sized risk.

To cope with severe crises in agriculture, the remaining provisions for public intervention are not likely to meet the challenges. Neither the provisions on private storage nor the trigger levels of public procurement have provided an adequate level of response in recent market crises – the 2009 and 2016 dairy crises, the 2011 fruit and vegetable crisis or the Russian embargo.

The current CAP also opens up the possibility of specific ad hoc interventions in the event of a crisis. The lack of structuring of these possible interventions, the absence of a guarantee of funding and action, and the lack of transparency on the way in which the EU is supposed to act make it a device at best uncertain, at worst lacunar. The crisis reserve suffers from having neither a clear mission nor an adequate mode and level of funding. Moreover, despite the numerous crises since its creation, which could have justified its use, the Commission has never proposed its activation.

This fuzzy framework of crisis management has two consequences:

– a wait-and-see attitude to hope that the public authorities will find exceptional financing; – without any assurance of their level of commitment to the situations encountered – which goes against the establishment of a solid management of risks and crises,

– a high degree of uncertainty and risk for agricultural sectors which limit their ability to invest.

The CAP therefore looks like a big building without a roof. Foundations (income aids), aisles and rooms (risk management tools, investment support) are carefully built, but in case of crisis, the building takes the water from the roof, endangering its own foundations.

In the absence of clearly managed crisis management at the community level, risk management tools are struggling to take off given the systemic risks to their long-term sustainability or their ability to ensure a consistent level of coverage over time.

The time has come to change this and provide the CAP with an adequate roof. The discussion on the new CAP offers us a unique opportunity to complete our common home, with the creation of a roof naturally consolidating the foundations and walls of the building by clarifying their role.

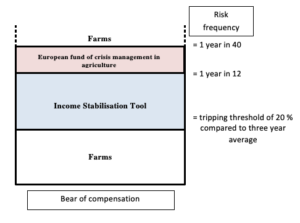

Figure 1: CAP Crisis Management Policy

By building on the decisions taken by European co-legislators to strengthen the private risk management tools co-financed by the CAP during the Financial Omnibus, the CAP reform must therefore:

– reinforce these risk management tools by increasing their attractiveness for farmers in order to offer effective response possibilities for average risk levels,

– to found a European device to take over these devices in case of deep crises. Such a scheme – the European Crisis Management Fund for Agriculture – is intended to provide secondary support after the action of risk management tools. It must be triggered on the basis of objective crisis level indicators valid for the entire European Union.

– build coherent and transparent risk and crisis management that encourages operators to react without delay to market signals and ban the delays inherent in the expectations and hopes of hypothetical interventions by the European Union and / or the national public authorities, often implemented with high deadlines.

In concrete terms, a European Crisis Management Fund in agriculture, financed by a multi-year crisis reserve and adequately equipped, should have the following missions:

- Act in partial reinsurance of private climatic insurance that meets the conditions set out in Article 70 of the Commission’s reform proposal (CAP Strategic Plans Regulation).This measure would help to provide such climatic insurance to farmers, reduce insurance premiums while the rate of coverage in the European Union remains too low.

- Provide second-rate support to farmers in case of market crises by taking over the income stabilization tools beyond a predefined crisis level.It will be a question of covering the part of the disbursements that these funds should operate without which these sectorial IST will not be able to survive a deep crisis of the market. Access to this second-tier aid could be open to non-IST producers, since no public aid would be allowed to substitute, even partially, with the help that ISTs would provide to their IST members. The aid released by the crisis fund, in the event of a serious crisis, would be released at European level, placing all European farmers on an equal footing. In addition, farmers covered by ISTs, such as farmers who are not, would have visibility to the ability of governments to respond to crises with predictable levels of emergency assistance. A farmer would thus knowingly do, depending on the level of risk associated with his production and investments, the choice to cover himself or not, being in the first case assured of triggering his IST and any additional contingency funds and for the second with only the second part, namely the emergency funds.

- Create a framework for rapid interventions through exceptional market measures in the event of a crisis with a view to minimizing the effects,acting quickly to rebalance market conditions. This level of action would be discussed immediately as market disruption signals trigger the risk management tools. Depending on the situation and the need, the managing authorities would be able to intervene through ad hoc tools.

The costs of managing such a fund would be minimal, since its interventions would be anchored on the risk management tools recognized under Article 70 of the draft Strategic Plan Regulation and Article 36 of the CAP currently in force. These tools are controlled by the payment services of each country, which are audited by auditors from the European Court of Auditors and audited by the Community level.

Criteria for triggering compensation by the Crisis Management Fund for point 1 (partial reinsurance of climate insurance) and point 2 (support provided in the wake of IST triggering) would be objectively predefined at the level of the European Union:

– a ratio of 170% of indemnities to be paid/premiums paid for climatic hazards (which corresponds to a crisis recurrence of one year out of 60), the commitment of the fund being capped at a value of 230% for this same ratio (risk frequency of one year out of 100),

– recurrence of market crises beyond which the crisis is described as major and triggers the crisis management fund in agriculture.

This threshold of recurrence of market crises will have to be determined by sector at a European level. For the dairy sector, based on the analysis of operating margins and on the basis of an econometric simulation, a 12-year recurrence appears as an economic indicator of a transition to a state of major market crisis. These thresholds defined at European level would ensure the activation of the fund when needed and in the regions concerned when the crisis does not uniformly affect a given sector throughout the European Union. As this frequency of risk is defined for the whole of the Union, there will therefore be fairness between the Member States without distortion of the market on the internal market.Thanks to these indicators triggering the European Crisis Management Fund in Agriculture, the response to a serious crisis would be predictable, rapid and thus limit the scope of the crisis and prevent bankruptcies of farms. The level of stress linked to the economic risk weighing on farmers would thus be reduced as soon as the public interventions were carried out within a clear, predictable framework, defined beforehand, which would not only be beneficial from the point of view of social sustainability and the attractiveness of the farming profession, but also in terms of investment, which is necessary, in particular, to achieve the Union’s sustainable development objectives.

Regarding the dairy sector, the selected crisis level threshold (12-year recurrence) would have triggered intervention during the 2009 and 2016 dairy crises. This triggering scheme for the crisis management fund would be applicable to all sectors. The compensation paid by the fund would not be reserved solely for farmers who have subscribed to an income stabilization tool, but would benefit all farms in the country and the industry where the triggering threshold has been exceeded. Farmers who participated in a fund would benefit from the risk management fund and additional emergency assistance associated with the crisis management fund. Operators having opted not to subscribe to an income stabilization tool would still benefit from the help of the emergency fund but would obviously not have the risk coverage of the pooling tool. This would be an economic choice for each farmer, depending on the resilience of his farm. Figure 2 summarizes the use of the Crisis Management Fund in Agriculture in the case of relay of farm income stabilization instruments.

Figure 2: Graph of the use of the European crisis management intervention fund in agriculture in the case of the agricultural income stabilization instruments relay for the dairy sector

It should be noted that the modeling carried out (see the Farm Europe technical note “Implementation of a European Crisis Management Fund for Agriculture”) results in an estimate of a total annual amount of public subsidy of € 420 million(2nd pillar CAP co-financing of 70%) for ISTs that would cover 70% of EU milk production.

The crisis management fund would intervene when IST compensation exceeds that of a risk with a frequency of one year out of 12 within the limit of a risk of one year out of 40.

Impact of this proposal for a milk producer in Germany:

This simulation is built under the assumption of the establishment of ISTs in the dairy sector in Germany, integrating only the milk component of the farms concerned. Given the characteristics of dairy farms in this country, three typical zones emerge that could encourage the constitution of specific ISTs.

Under the assumption of common IST criteria, with a deductible of 30% applying to it:

– such an IST would have intervened in support of dairy producers in 2009, 2015 and 2016 for aids paid of approximately 42 €/T in 2009, 19 €/T in 2015 and 29 €/T in 2016.

– The proposed European crisis management fund would then have covered part of these aid payments, up to € 17/t in 2009 and € 4/t in 2016.

– The annual contribution that the producers would have had to pay for this IST being, for its part, at 1.55 €/t (excluding management costs of the IST fund).

For climatic risks, the fund would make it possible to put an end to the ad hoc financial interventions decided in the emergency by certain Member States (according to their financial means and their political attentions) in the event of climate disasters. The fund would not be intended to take the role of reinsurers, but to reduce the overall cost of crop insurance by reducing the cost of reinsurance (cost reported in insurance premiums paid by farmers) and to promote the development of this tool throughout the European Union.

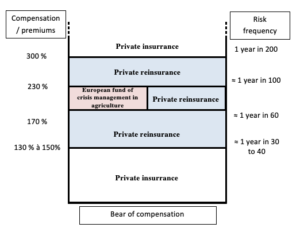

To ensure rigor and share the costs of reinsurance between public and private, access would be restricted provided that half of the compensation paid is derived from private funds (insurance or reinsurance). Figure 3 summarizes the use of the Crisis Management Fund in agriculture in the case of climate insurance reinsurance.

Figure 3: Graphical representation of the use of the European crisis management intervention fund in agriculture in the case of climate insurance reinsurance

To cover 70% of European production in the cereals, industrial crops, potatoes, wine and fodder sectors, the total amount of CAP co-financing at 70% of insurance premiums would then amount to EUR 3 847 million a year.

The European Crisis Fund would then act in partial reinsurance for events of frequencies between 1/60 and 1/100. The pooling of this reinsurance risk at European level limiting the precautionary financial amounts to be put in place.

Average loss levels by crop type likely to trigger climatic hazard reinsurance by the crisis fund (Germany or France type ocean area)

Cereals: 27% Industrial crops: 27%

Potatoes: 28% Vines: 31% Fodder plants: 33%

By building these methods of intervention of the European Agricultural Crisis Management Fund, any risk of windfall effects is eliminated:

- in the case of intervention in response to severe climatic hazards, the fund would take over the weather insurance only for a level of serious hazards, so clearly after the normal triggering of compensations borne entirely by private insurers. This second relay action, and for only 50% of the share of the reinsurance systems for hazard levels between 170% and 230% of the ratio of compensation to pay/premium paid, excludes any risk of deadweight effect and distortion of the device.

- in the case of intervention in response to strong market risks by releasing ISTs for recurrence crises greater than a fixed level, this device will not encourage any irresponsible individual risk-taking behavior, because only intervenes in addition to the ISTs tools set up by sectors and whose parameters have been validated by the Member States and by no means in substitution. In addition, such a system must prohibit any public aid that would replace the compensation paid by the ISTs for farmers who have chosen not to adhere to an IST. Conversely, second-tier support from the mutual fund could be provided to both IST and non-IST farmers in the region and the industry in crisis.

- With regard to the exceptional market measures that could be decided on the basis of the voluntary milk production reduction measure set up in 2016, they must aim at rebalancing the supply/demand levels and in no way bring about an additional support to income without counterpart, which would then undermine the private risk management tools reinforced by the Financial Omnibus and confirmed in Article 70 of the proposal for a Regulation on National Strategic Plans.

Note on the compatibility of the proposed measure with the EU’s WTO commitments, the fund meets WTO green box rules for 30% deductible and compensation of up to 70% losses and for other measures is exempted from the reduction commitments of the orange box (or AMS).

The fund should have a capital of EUR 1.7 billion, which would make it possible to deal with crisis situations that may arise in different agricultural sectors and to finance adequately linked actions. This allocation may be envisaged either on the first day of the creation of the fund by decision of the Heads of State and Government in the framework of the discussions on the European Financial Framework 2021-2028 or failing that, progressively between 2021 and 2023.

Since the fund would be solicited, it would be replenished in the following year or years at the rate of € 400 million per year and within the limit of a total amount of the fund of € 1.7 billion.

This level compares favorably with the € 2.8 billion that the EU has spent to deal with only the dairy crisis. If this fund had been operational, the expenses would have been much lower.

This amount of € 1.7 billion was established in the light of the experience of past crises and the actions that would have been financed if such a fund had existed, taking into account that:

– climatic crises are more systemic in nature when they occur

– if market crises may exist in a single period in several sectors, the probability that all agricultural sectors will be affected at the same time is statistically low.

Therefore, it seems relevant and sufficiently secure that the fund has in reserve the equivalent of 4 years of action – while the risk of a continued continuation of such crises is low – due to:

– Reinsurance of climate insurance (annual precautionary allocation of 150 M €/year to the crisis management fund),

– Takeover of agricultural income stabilization instruments (annual precautionary allocation of 135 M €/year to the crisis management fund)

– Rebalancing supply/demand measures (annual precautionary allocation of 130 M €/year to the crisis management fund)

– with an additional 5 million €/year to finance the communication tools on risk management tools, research and development on risks in agriculture in Europe.

Solidarity and mutualisation allow economic efficiency, which is a foundation of European agricultural policy as it was put forward when the CAP was created.

NB: In this scheme, traditional crisis measures such as public intervention and private storage aid should continue to be financed in addition to these credits, as they are now financed outside the crisis reserve. It should be noted, however, that the use of rebalancing measures (so with quick and targeted triggers) would significantly reduce the need for a public storage policy.