EU wine sector: need of a wake up call for Europe

During the last decades, the European wine sector has been able to keep up with the increasing competition both in the domestic and in the world’s markets. It built its strategy on enhanced quality & productivity, while meeting higher environmental and sustainability standards which were becoming an always more important aspect of the product.

In a context where the EU exports in the global market have being losing around 10 percentage points a year, in which the domestic consumption has been falling by 30% in the last few years while the imports of non-EU wine were on the increase, wine cooperatives have been able to strive and rebound.

This has been possible due to a combination of, on the one hand, the resilience of the European producers, who were able to adapt and innovate, to build on the solid foundation of EU traditions, and, on the other hand, to the vision and strength of the public support policies intended to promote the European way of producing and enjoying wine worldwide while protecting the local savoir-faire.

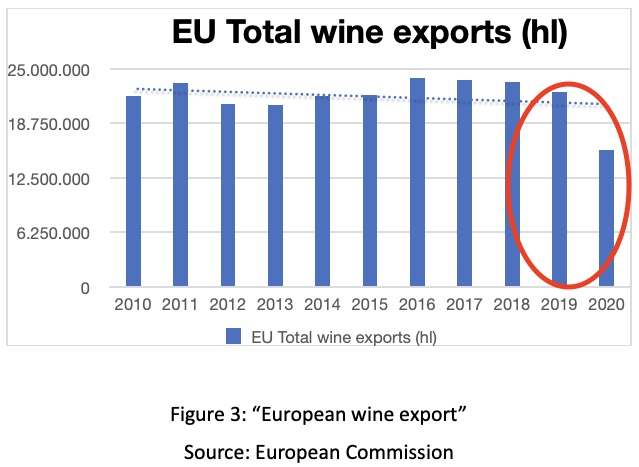

However, the EU wine sector is now at the tipping point and cannot afford to rely on its past achievements anymore. The Covid-19 restrictions and the consequent closing of the HoReCa sector meant a drop in export of 30%, while due to the cumulative impact of Covid and of the implementation of the China-Australia Free trade agreement, the EU exports to China have been reduced by almost 57%, not to mention the impact of Brexit.

In addition to these economic challenges, the wine sector is one of the first affected by climate change, as recent frost waves reminded. The multiplication of extreme weather conditions has a direct impact on wine production.

Therefore, without a new impetus, the EU wine sector risks to lose its position as a global leader that creates trends, markets, and prices. The wine is still perceived as the case study for success stories in the EU agricultural sector, but this perception must not overshadow the challenges to overcome. To keep its position as a locomotive for Europe, urgent actions are needed to support it, questioning the status-quo and building new strategies.

Many decision leaders, notably from the European institutions admitted the dire situation the EU wine sector lies right now:

Commissioner Wojciechowski, “the wine sector has been among the sectors hit the hardest by the coronavirus crisis and the related lockdown measures taken across EU”. The loss “was not compensated by home consumption”.

Former Italian Agriculture Minister Teresa Bellanova reminded that “to the structural market difficulties, the Covid-19 pandemic was added, which left deep wounds”.

At the same time, social and economic sustainability will be needed in order to achieve the environmental one, as MEP Anne Sander (FR, EPP) put it: “the economic aspects and sustainability are the two faces of the same coin […] we need both to guarantee the environmental and climate one”.

MEP Pina Picierno (IT, S&D) said that the “picture is particularly bad. The wine sector is suffering […] because of the pandemic, the HoReCa closing, the tariffs”.

Europe needs a plan

”We implemented several aids […] since this summer to help the industry. However, we already know that, at a certain point, they will not be enough”, Julien Denormadie, French Agricultural Minister, echoing many Member States (cf Council’s documents for similar declaration of the delegation of Bulgaria, Croatia, Slovakia among others).

MEP Tolleret (FR, Renew): “the good state of the market before the Covid crisis […] showed that the political choices were appropriate [for the sector]”.

President of the Spanish Cooperatives, Angel Villafranca: “we cannot face an extraordinary situation with ordinary tools”.

Francisco Martinez Arroyo, adviser for the Spanish Castilla-la Mancha government: “the sector needs [additional support] more than ever in this moment”, “If we only got additional funds, that should not be taken from other tools”.

Global trends and competition (“New world”), tariffs, Brexit, Covid-19 pandemic, and climate change are posing serious threats to European wine producers, and, therefore, to the economic and cultural influence of the sector.

Today, an EU economic recovery and climate adaptation plan for the next three years is needed with no delay.

It will take at least 2 years to relaunch the dynamics of the demand. The crisis has profoundly disrupted consumer habits, making the path of complete recovery longer and more difficult. It is, therefore, high time to act both on internal consumption and focus on exports. At the same time, recovering from the economic crisis must support the ecological transition to respond to climate change.

Adequate means are needed to respond properly to the crisis and the challenges of the near future.

First of all, the extension of the crisis measures for the whole of 2021 & 2022 is needed. In fact, the crisis measures will be in place until October 2021, but this delay will not be enough to cover the expenses related to production, stockage and distribution of the ongoing production. Subsequently, the national support programs must be enlarged and financed with a substantial budget. It is not credible to imagine that emergency measures can be financed within the existing PNA budgets. That would mean delaying the structural actions that the EU wine sectors needs to prepare for its future.

Current crisis measures are still needed but not enough.

A multi-annual plan is also required to give priority to viticulture and to bring additional economic resources:

- Exceptional storage and distillation measures for 12 months to smooth out the marketing of the large stocks that have built up due to the closure of the HoReCa and export markets over the past two years.

- Massive investment plan on innovation to assure the transition of the wine production chain towards precision viticulture. Investments at vineyard level to increase competitiveness, in particular to stop losing market share on medium range markets. The priority should be given to old and unirrigated vineyards so to increase the quality of the production and its competitiveness.

- Increased actions aiming at re-gaining markets’ shares and to open new ones: strengthen the funds dedicated to the promotion of European wines in exports and increase communication on the domestic market, notably by underlying the tools and efforts that EU wine producers are making in order to increase the sustainability of their production. Consolidate existing markets and reconquer market shares on medium range markets which are the priority of New World producers.

- Investment plan in research of new breeds, notably on New Genomic Techniques as a tool to face the challenges related to climate change and consumption expectancies.

- Investment plan to tackle the water access challenge and face water scarcity in most wine producing regions.

Key economic indicators

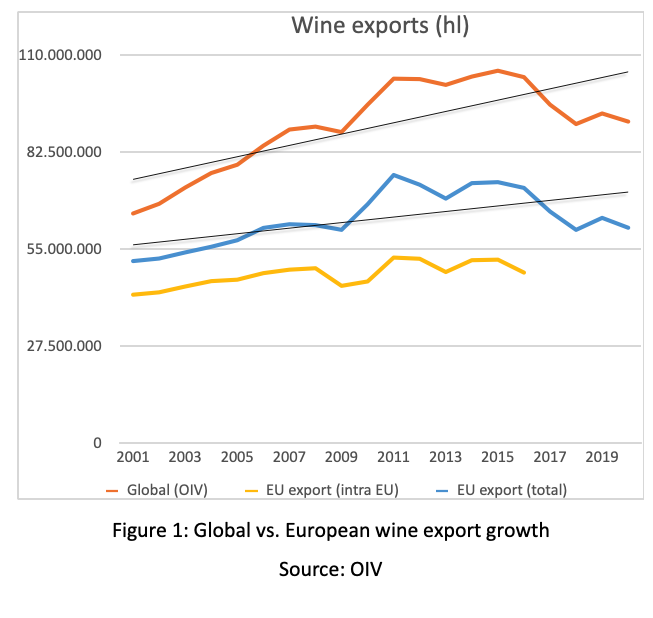

The general trend shows a growing market for EU wines exports since the beginning of the 2000’s. However, this has been possible only because the global trend has been improving as well, making the EU growth, relatively little (Figure 1).

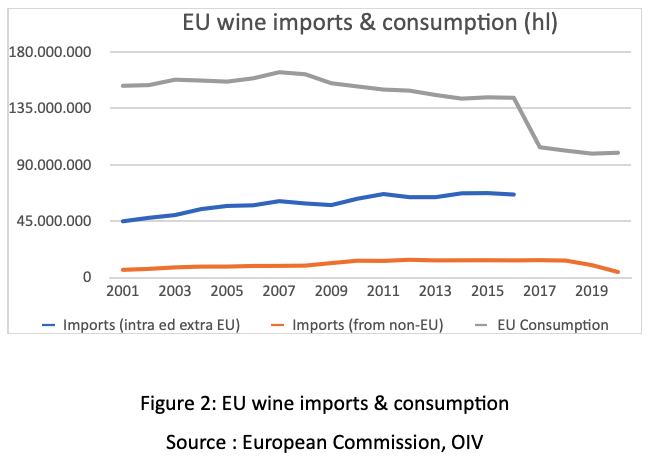

Since the beginning of the 2000’s the European growing exports rates have been relatively decreasing if compared to the world’s one. The EU has been losing its presence on the global market, being replaced by other competitors. In 2001 the EU total wine trade represented 79% of the global one. In 2016, it represented 70% despite the constant growth in its exports. In other words, if at the beginning of the century the non-European section of wines that were present in the global market was between 13 mhl and 20 mhl, nowadays the figure increased to more than 30 mhl. In parallel, on the domestic market, while imports from non-EU countries have been increasing, European consumption has been constantly falling. In particular, starting from 2008/09, to a soft peak of imports it follows a slow but constant decreasing level of EU wine consumption (Figure 2). Non-EU wines are increasingly present on Europeans’ tables, at the expenses of European production.

Both the external (exports) and the domestic (imports) data show that European wines are losing markets’ shares in favour of third-countries products. This situation requires a strong response, notably with the draft of an action plan designed to give dynamism to the EU wine industry.

Key COVID indicators

As if these external threats were not enough, in 2020 the whole world has been hit hard by the Covid pandemic which, besides the human catastrophe, it came with an economic one. Despite the resilience that EU farmers showed during the crisis, without letting people down on their expectations to supply food, many agricultural businesses, notably SMEs, faced the worst of the consequences. In particular, the activities strongly related to the HoReCa industry, have been forced to stop their usual distribution channels. Due to that, estimates talk about a loss of 30% of the volume and 50% of the value sold in the EU. Exceeding stocks, reduction of selling capacity, reduced purchase power of consumers, reduced exports and consumption, decreased tourism, cancellation of events and festivals are some of the consequences that Covid-19 restrictions had on the wine sector. The restrictions imposed by governments led to an abrupt change in the purchasing behaviour of consumers and, therefore, a sudden change required by producers as well: sells from wine specialty stores dropped by 35%, exports by 36%, and 91% from restaurants and hotels. While 77% of the hotels & restaurants had to close (at least temporarily), 25% of wine businesses followed the same destiny, with almost 60% of wine businesses reporting economic losses due to Covid-19 (70% of the businesses were small wineries). Despite the increase in the online selling channels, most of the wineries could not compensate the losses from the important reduction of HoReCa, exports, and tourism. This is a “demand crisis”, said MEP Paolo DeCastro (IT, S&D) “and we will have to face it as such”.

Climate Change impact on vines

Wine is at the forefront of the climate challenge, with urgent need of adaptation. There is a direct link between the specificity of the products and climate conditions. Climate variations have major impact on quality, and urgently call for innovation, new varieties, etc.

Climate change is another difficult threat to overcome. On one hand the natural events that are the consequence of global warming are more and more unpredictable, what it makes it more difficult for a wine grower to prepare (tools, assurance, etc.), to recover, and to plan (leading to uncertainties when it comes to business planning and consumer relations). On the other hand, transition towards production methods that would reduce, or even nullify, the negative impacts on the environment & biodiversity, while improving wine production and quality require high investments and redesign efforts. Climate change affects agricultural production as a whole and while action has to be taken to target the core of the issue (middle-to-long-term target), producers should also be able to face current events that put them on the brink of going out of business.

In recent months, the unusual frost wave that touched the majority of Western and part of the Central and Southern Europe during the month of April 2021 had devastating effects on agricultural production, notably on the vines, leaving vine growers, already concerned by the Covid pandemic economic crisis, in an even greater state of incertitude. Many of us were not covered by insurance against frost. Climatic events have been hitting the sector since 2017, where yields had suffered from another frost wave, in 2018 when they were hit by mildew, and from the heatwave in 2019.

We joint the call of the co-chair of the EU Parliament intergroup on wines, MEP Tolleret (FR, Renew), when she says that “at the European level, climatic insurances are not sufficient”, calling for European reinforced support to insurance scheme for wine growers.

Global scenario

With a look at the international markets, it is important not to forget the consequences of more than a year of trade war (introduced in October 2019) against the EU biggest importer of wine, due to the Boeing-Airbus issue. In this context, the US authorities imposed a 25% ad valorem punitive tariff on EU wines, that resulted in a 54% drop in exports of the targeted wines. The estimated loss for the EU wine exports derived from the trade war amounts to a drop in the 2019/20 campaign of 10% (or €8 billion), what led French Agriculture minister to say that “this is a disaster for our vine growers”. In this context, the cooperative model has shown its resilience and capacity to overcome the challenges with creativity and endurance. Confronted with the “Trump taxes” we managed to develop alternative markets, for example via BagInBox solutions to maintain volumes exported. Even if the recent developments in the Transatlantic trade relations have unfolded positive news for the economic sectors that have been involved in the trade war (a five-years truce has been agreed upon), if we consider the scale of the cumulative effects of climate, trade and economic tensions, the wine sector urgently needs support from EU decision-makers.

Still on global trade issues, it is worth also to mention the relations between China and Australia as an example of the unpredictable exogenous forces that drive global trade relations and that cannot, by definition, be controlled. In fact, after the implementation of a Free Trade Agreement (starting in 2015) for which direct tariffs on wine have been reduced, the EU wine sector has seen its share of the Chinese market drop, with negative economic consequences on the European businesses. However, recent disputes between the two Asian partners on trade issues have been involving the wine sector as well, damaging, notably, the Australian exports of wine to China (that, after the FTA have come to represent more than a third of China’s wine imports, for a value of almost €1,9 billion annually). Following a 200% Chinese tariff of Australian wines, these have dropped by 96% between December 2020 and March 2021 compared to the previous year, halting, as a matter of fact, Australia’s wine trade to its biggest commercial partner. This situation is forcing the 37% of Australian exports that normally goes to the Chinese market to find alternative markets to release the pressure. If this surely represents a threat to our European industry, it also represents an opportunity for us to insert our products in the Chinese market as a supplement for the missing Australian beverage. This example underlines the unpredictable dynamics of global trade relations on which we so strongly depend on, given the high export-oriented sector we work in, and considering that in the close future exports will represent a higher share of our trade if we take into account the decreasing consumption rates within the EU. In order to succeed in the export markets, beside a strong promotion policy, we need to know what the future holds for us, meaning that stability in the EU trade policy is of outmost importance for assuring a healthy European wine industry. In this context, we call for a stronger commitment of the EU to develop even further trade relations with historic and new partners setting the base for improved conditions for the sector in current and future Free Trade Agreements. To this respect, we welcome and support the initiative of the Commission to review the EU Trade Strategy hoping that it will renew and defend the dynamism of our wines.

On a more continental scale, Brexit represents a close-by threat that seems to have been forgotten. The UK market for wine, in fact, represented 22% of the EU exports in 2019, and its imports from Europe (between 55% and 60%, worth around €1.8 billion) are at risk. With the trading issues deriving from the separation of the UK from the EU, the increasingly time-consuming paperwork, tariffs, and costs, we found ourselves in a funnel whose unblock seems very unlikely. Despite the efforts done in the years of negotiation of the Brexit deal, the trade impact that the current accord has on the European wine industry is detrimental. Even if Brexit has come into effect “only” in January 2021, its impact can already be perceived from us on the field. This can no longer be the case.

The EU Green Deal and Europe’s Beating Cancer Plan

The European Green Deal can be an opportunity or a threat for the European wine sector depending on how it is implemented. About 50 proposals will be put forward in the coming months having direct and indirect impact. While the environmental objectives are widely supported, the policy path will be a major challenge: it can lead to constant de-growth with extra constraints and administrative burdens, or on the contrary, to a double performance strategy that responds to societal expectations and promotes economic and environmental growth. If, as we hope, the outcomes will be closer to the latter scenario, we will be asked to invest in new technologies, patterns, and tools to comply with the demanding and needed changes that are foresaw. To that end, increased public support will be needed to our sector in order to accompany the wine value chain in this transition.

The input reduction strategy and the labelling initiatives will be the most important initiatives for the sector. For both, science and innovation must be mobilised. This should also apply for the Commission’s Beating Cancer Plan. As such, moderation in the consumption of every product is what makes a diet balanced, not the demonization and, therefore, the exclusion of some of them.

Irène Tolleret, MEP: “In order to fight against cancer, I think that we can implement positive actions instead of applying an approach based on the demonization of certain products. […] the main problem is in abusive consumption. All in all, any ban will lead to the transgression of the rules”.

Several scientific studies confirm the positive effects on health of moderate wine consumption in the context of balanced diet and regular physical activity. Its effects have been analysed on cardiovascular diseases, metabolism, thrombosis, hypertension, renal & neurodegenerative diseases, diabetes and cancer and it seems that “all these data, rather controversial, lead us to think that the beneficial effects could be due to both to polyphenols and alcohol”

As many scientific studies show, in fact, moderate consumption of wine, which is an important element of the Mediterranean diet as such, has positive consequences on the general health of the one who consumes it – surely within the context of a balanced diets and regular physical activity-. Communication campaigns aimed at educating the public to the benefits of moderate consumption of every product should be considered, given the fact that promoting the absolute abstention of any product never resulted in the expected outcome.

Recommendations

In this complex context, us, European wine farmers, have been acting in our best efforts, trying to come up with creative ideas by strengthening our adaptability. However, we have been feeling the absence of our long-standing partner in the success story that European wine has become. The European Commission in these past months has remained silent and deaf to our calls. Whatever the threat, being the Covid pandemic, climatic disasters, trade war, Brexit, the only answer that we have been receiving from its services is “there is simply no money”, answer that has been reiterated recently after the frost wave.

This answer is simply not credible nor understandable, considering the amounts of funds that the EU has moved for other strategic sectors and the importance of the economy generated by our industry for more than 50 regions and the EU in general, representing 2.5 million works, more than half of the European trade balance, and the image of the EU agri-for products, whose wines are the best ambassadors.

A renewed private-public partnership as secret of success

The duo private-public has shown its potential when cooperating over the last two decades, putting back on promising track the wine economy, overcoming the challenge of the new world production. It is now the time to write a new success story, building the foundation of a new cooperation for the benefit of jobs, economy, environmental features and protection, and European identity.

It is therefore urgent for the European Commission to take actions, complementary to those initiative taken at local, regional, or at national level.

* * *