Introduction

« I should like to draw your attention to a recent proposal of the European Commission to favour the use of biofuels. (…) The aim is to give by fiscal means a kickstart to the development of a viable biofuel industry in the Community. This initiative to establish a significant renewable energy source in the Community would conserve scarce non-renewable energy resources, certainly improve the Community’s energy security and make an important contribution to an improved environment. »

Cardoso e Cunha, European Commissioner for Energy 27 February 1992

The biofuels industry was born from political ambition: the ambition to develop and strengthen the resilience of the agricultural sector as a whole, while finding an alternative to the fossil fuels and imports on which the European Union heavily depends.

Since the 1990s, biofuels have developed and benefited from a positive perception in society, as a positive step forward both from economic and environmental perspectives. Fiscal incentives and direct support to farmers were provided in order to unlock the potential of this new, EU based, renewable source of transport energy, including in the context of the 2006 biofuels strategy.

« Now more than ever, the biofuels sector needs our support and encouragement. Europe remains far too dependent for its energy needs on imported fossil fuels. As Commissioner for Agriculture and Rural Development, I am always on the look-out for new outlets for Europe’s farmers. Biofuels offer huge new possibilities ».

Marianna Fischer Boel, European Commissioner for Agriculture 8 February 2006

The perception and the nature of the debate changed in 2007, when, in the context of food riots in developing countries, biofuels were blamed. Yet today, it is now clear that the oil price spike, which impacted the prices of all commodities, was the driving cause of price peaks and that biofuels played little or no role.

As a consequence, this new context overshadowed the positive arguments, which were at the foundation of the development of the sector. Furthermore, these new perceptions paved the way to further concerns and misconceptions, which are still central to how biofuel policy is approached in Europe.

Progressively, European institutions encouraged and promoted second and third-generation biofuels[1], giving less importance to the potential benefits of conventional agricultural sources of renewable energy and relying upon the notion that advanced biofuels, which are highly dependent on coherent regulatory development and substantial investments, could replace the conventional ones.

However, in the meantime, the global context profoundly changed again.

Long-term high food prices forecasts failed to materialise – and global agricultural commodities are now facing sluggish long-term forecasts.

Figure 1: World Biofuels production 2008-2020

Source: own calculations based on IEA, (2015), Medium-Term Renewable Energy Market Report 2015, OECD/IEA, Paris

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| OECD Americas |

61.0 |

62.8 |

63.2 |

62.0 |

61.4 |

61.4 |

61.3 |

| United States |

58.9 |

60.6 |

61.1 |

59.9 |

59.6 |

59.6 |

59.7 |

| OECD Europe |

16.3 |

16.9 |

17.7 |

18.1 |

18.6 |

18.8 |

19.5 |

| OECD Asia Oceania |

0.8 |

1.0 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

| Total OECD |

78.1 |

80.5 |

81.8 |

80.9 |

80.8 |

81.0 |

81.6 |

| Total non-OECD |

49.0 |

55.4 |

57.4 |

59.3 |

60.7 |

61.7 |

62.8 |

| Total world |

127.1 |

135.9 |

139.2 |

140.2 |

141.5 |

142.7 |

144.4 |

Figure 2: World Biofuels production 2014-2020

Source: data obtained from IEA, (2015), Medium-Term Renewable Energy Market Report 2015, OECD/IEA, Paris

The two figures above, show that from 2014, biofuel production in OECD Europe increased by around 1.2 billion liters per year.

Overall, global growth in biofuels production was achieved in 2014 and forecasts for 2020 point to 144.4 billion liters.

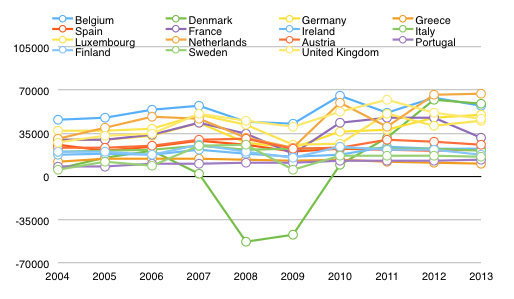

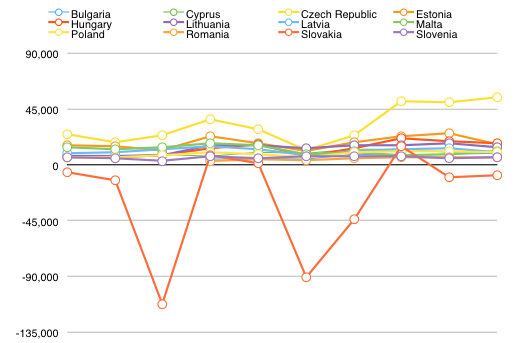

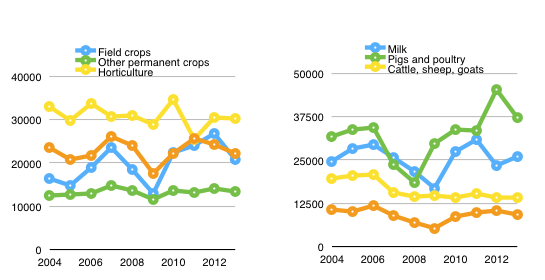

First-generation biofuels (also known as conventional biofuels[2]) production levels, are much higher today than during the last food price hike[3], while global agricultural commodity prices are facing bearish markets[4] (see also Figure 3 below[5]).

Figure 3: World biofuel prices (Nominal prices) 2005-2025

Source: data obtained from OECD Agricultural Statistics (database)

This price context signals bad news for agricultural investments, thus, also bad news for long-term food security.

As a result, Farm Europe considers it necessary to re-open the debate on domestically sourced conventional or first-generation biofuels, taking into account their overall contribution to the agricultural economy, the environment and rural development in the European Union, trying to go beyond preconceived perceptions and ideological stances.

It is important to note as a preliminary remark, that this report aims to build a renewed approach to biofuels in the European context. One cannot develop a sound strategy for biofuels without taking into account the “local” agricultural challenges for a targeted area, including the level of food security or food insecurity and the local drivers behind demands on land use.

These reflections are particularly relevant now, since work on the EU’s post-2020 transport decarbonisation policy process commenced. The Commission is actively working on new draft legislation (starting with the release in July 2016 of the “Low-Emission Mobility Strategy” and the projected release of the RED II proposal) expected for the end of the year and in which it is considering a proposal to more than halve conventional biofuels by 2030, by reducing sharply the maximum allowed contribution of these biofuels to the EU renewable energy target (specifically from 7% to 3.8%).

In this framework, this report aims in particular to shed light on the challenges and situations for the European Union, considering that at the global level, the EU remains a modest player in this field.

1) Biofuels in a nutshell

Originally, the European Commission described biofuels as: “liquid or gaseous transport fuels such as biodiesel and bioethanol which are made from biomass. They serve as a renewable alternative to fossil fuels in the EU’s transport sector, helping to reduce greenhouse gas emissions and improve the EU’s security of supply”[6] . It is worth noting that in the relevant debates, biofuels are commonly labelled as either: (a) “food-crop based” or “advanced renewable” biofuels, if one refers to the European Commission texts, (b) “crop based” or “advanced” biofuels, in existing EU law, (c) “land based” or “waste” biofuels, among NGOs, (d) “conventional” or “advanced”, if one is in a more global setting than Brussels, where biofuel feedstock is the distinction being applied, or (e) “first-generation” or “second-generation”, if again, one is in a more global setting than Brussels and process technology is the distinction being applied.

To sum up, the terms used to describe biofuels are, unfortunately, loaded ones. One of the greatest challenges in biofuel debates is that the language and terminology used, often frustrates objective analysis. This paper defers to how the world’s experts speak about biofuels, as conventional and advanced.

The two most common types of biofuels in use today are bioethanol and biodiesel. Bioethanol is made from starch (cereals) and sugar (beets and cane) crops, while biodiesel is produced mainly from oilseeds, like rapeseed and sunflower, soya, as well as from palm.

a) Biofuels in the European Union

In 2014, 13 Mtoe of biofuels were produced in Europe. Biodiesel made up 72% of this total, while bioethanol reached 28%[7]. EU bioethanol production (primarily for fuel, but around one quarter for other uses) reached 3.6 Mtoe, benefitting from low feedstock prices and restrictive measures on bioethanol imports. Regarding EU biodiesel, production in the EU is expected to remain almost stable in 2016 at 9.8 Mtoe and increase to 10.2 Mtoe in 2017.

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

| Production |

11.2 |

12.0 |

13.2 |

13.1 |

13.9 |

14.5 |

14.8 |

15.2 |

15.2 |

15.1 |

15.0 |

14.9 |

14.7 |

14.4 |

| Ethanol |

3.4 |

3.4 |

3.6 |

3.7 |

4.1 |

4.2 |

4.3 |

4.4 |

4.4 |

4.4 |

4.4 |

4.4 |

4.3 |

4.3 |

| …based on wheat |

0.8 |

0.9 |

0.9 |

0.8 |

1.0 |

1.1 |

1.0 |

1.0 |

1.0 |

1.0 |

1.0 |

0.9 |

0.9 |

0.9 |

| …based on other cereals |

1.3 |

1.3 |

1.5 |

1.5 |

1.7 |

1.9 |

1.9 |

2.0 |

2.0 |

2.0 |

2.0 |

2.0 |

2.0 |

2.0 |

| …based on sugar beet |

0.6 |

0.6 |

0.7 |

0.6 |

0.6 |

0.5 |

0.5 |

0.5 |

0.5 |

0.5 |

0.5 |

0.5 |

0.5 |

0.5 |

| … 2nd gen. |

0.0 |

0.0 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

| Biodiesel |

7.8 |

8.6 |

9.6 |

9.5 |

9.8 |

10.2 |

10.5 |

10.8 |

10.8 |

10.7 |

10.6 |

10.5 |

10.4 |

10.1 |

| …based on vegetable oils |

6.9 |

7.5 |

8.1 |

8.0 |

8.0 |

8.1 |

8.2 |

8.3 |

8.3 |

8.2 |

8.1 |

8.1 |

8.0 |

7.7 |

| …based on waste oils |

1.0 |

1.1 |

1.4 |

1.5 |

1.7 |

2.0 |

2.2 |

2.4 |

2.4 |

2.3 |

2.3 |

2.3 |

2.3 |

2.2 |

| …other 2nd gen. |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

| Consumption |

14.1 |

12.9 |

13.5 |

13.3 |

14.2 |

15.0 |

15.7 |

16.1 |

16.4 |

16.1 |

15.8 |

15.5 |

15.1 |

14.7 |

| Ethanol for fuel |

3.1 |

2.6 |

2.8 |

2.6 |

3.1 |

3.4 |

3.7 |

3.8 |

4.0 |

3.8 |

3.7 |

3.6 |

3.4 |

3.3 |

| non fuel use of ethanol |

1.2 |

1.2 |

1.2 |

1.2 |

1.2 |

1.3 |

1.3 |

1.3 |

1.3 |

1.3 |

1.3 |

1.3 |

1.3 |

1.3 |

| Biodiesel |

9.8 |

9.0 |

9.6 |

9.4 |

9.8 |

10.3 |

10.7 |

11.1 |

11.1 |

11.1 |

10.9 |

10.7 |

10.4 |

10.1 |

Figure 4: EU biofuels market balance (Mtoe) from 2012 to 2025

Source: data obtained from DG AGRI, European Commission

While, in Figure 5 below the evolution of EU production of biofuels from 1990 to 2013 (ktoe)[8]:

Figure 5: Evolution of EU production of biofuels 1990-2013 (ktoe)

Source: data obtained from Eurostat

As it is clear from the Figure above, production of biodiesel and bioethanol expanded rapidly in the EU between the period 2005 and 2010[9].

Bioethanol:

On the production side, ethanol is a purely biological process in which enzymes are used to break down starches into sugars and then yeasts are used to convert sugars into ethanol. The products of these processes also result in high quality feeds for livestock and specialty nutrition products, with as much feed being produced as ethanol. Feedstock like beet and maize often play a relevant role in crop rotation and their cultivation brings benefits in terms of greater diversity.

In Europe, maize is the main feedstock used to produce renewable ethanol (5.4 Mt / Wheat 4.3 Mt) with almost all of that maize produced in Europe. As a practical matter, the EU ethanol industry no longer imports its feedstock from outside Europe. It is estimated that in 2014 only 3%, or 10.5 million tons, of EU cereals output was used to produce ethanol. Figures for 2015 do not differ from 2014 estimates (see both Figures below). Half of it is represented by maize[10] – so only for 0.7% of EU agricultural land and 2% of Europe’s grain supply[11] are involved, illustrating the high level of self-sufficiency that Europe has in ethanol capacity.

Figure 6: Type of feedstock used to produce renewable ethanol in the EU

Source: own calculations based on ePURE data

The EU production capacity quadrupled from about 2,1 billion liters in 2006 to about 8.5 billion liters in 2013, allowing the EU to reduce significantly its imports from third countries while meeting growing EU demand.

Figure 7: Bioethanol, EU supply & Demand (million Liters)

Source: GAIN Report (EU FAS Posts)

Biodiesel:

Biodiesel is a renewable fuel that can be produced from domestically cultivated and processed oilseeds (rapeseed mainly, sunflower seeds and soybeans). Today, biodiesel produced in the EU derives first from rapeseed. This share has decreased over recent years with the emergence of expanded global palm oil supply.

Rapeseed used for the production of biodiesel is cultivated within the EU as a break-crop, which means basically that the agricultural product is grown after a sequence of cereal cultivation and plays a vital role in diversifying production, preventing plant diseases, managing weed and pest levels, restoring essential soil nutrient and nitrogen balance, and improving soil structure.

The introduction of alternative species (break-crops) into the cropping sequence boosts yield and reduce the need of inputs for the following crops. Indeed, rapeseed cultivation reduces the need for fertilisers, contributing in this way, to the GHG reduction target.

Rapeseed oil is the dominant biodiesel feedstock in the EU, accounting for 55% of total production in 2014, and 49% in 2015[12].

The development of the rapeseed sector is generally attributed to three drivers: the need for a degree of independence in oil seed capacity (after suppliers from the Americas were found to be volatile), the opportunity for using set-aside land as a source of non-food income for farmers, and European climate legislation for biofuels.

However, its share in the feedstock mix has considerably decreased compared to the nearly 100% in the early stage and even around 60% in 2012 (see Figure below). This is mostly due to higher use of imported palm oil linked to new plants using HVO (hydrogenated vegetable oil) technology which is not subject to the technical limits of palm use as the conventional FAME (Fatty acid methyl ester) plants. Recycled vegetable oil/used cooking oil (UCO), is also being produced both locally, but with a growing part being imported (UCO was the third most important biodiesel feedstock in 2015).

Contradictions around the use of UCO as an advanced biofuel arise in part because collectable UCO volumes in Europe amount to just a couple of litres per person per year or less than 1% of the amount of diesel fuel consumed per person on Europe’s roads[13]. Hence UCO imports will make up the majority of supply in any market in which UCO biodiesel is a growing biofuel. This is significant because UCO outside the EU is generally not a waste and is used for both feed and fuel. Its preferential use in Europe as a non-feed “waste” is thus highly questionable and appears to contradict the Waste Framework Directive’s instruction never to create waste if that is avoidable.

| |

|

| Feedstock |

2016F |

2015 |

2014 |

2013 |

2012 |

| Rape oil |

6.18* |

6.47 |

6.32 |

5.71 |

5.60 |

| Palm oil |

3.08* |

3.35 |

3.27 |

2.78 |

1.92 |

| Soya oil |

.52* |

.48 |

.49 |

.29 |

.42 |

| Sunflower oil |

.09* |

.10 |

.17 |

.08 |

.13 |

| Tallow&Greases |

.43* |

.44 |

.43 |

.41 |

.36 |

| Others |

.08* |

.06 |

.08 |

.08 |

.05 |

| Used/waste oil |

1.50* |

1.47 |

1.44 |

1.30 |

1.26 |

| Biodiesel output |

11.88* |

12.37 |

12.20 |

10.65 |

9.74 |

Figure 8: EU28 feedstock used for biodiesel production (Mn T)

Source: data obtained from ISTA Mielke GmbH

HVO recent expansion explains palm oil rise use as biodiesel feedstock.

Figure 9: HVO, Palm & FAME Biodiesel feedstock and production 2006-2015 in Millions T

Source: FO Licht

In recent years, palm oil use has increased due to the production of HVO: from 230kt of HVO used in 2009 in EU to 1800kt in 2015. Almost all the HVO production is made of palm oil.

Today, in the European Union, France, Germany (main producer), the UK, the Czech Republic and Poland are the main producers of biodiesel. According a 2011 IEA report titled “Technology Roadmap Biofuels for Transport”: “global biofuel consumption can increase in a sustainable way – one in which production of biofuels brings significant life cycle environmental benefits and does not compromise food security – from 55 million tonnes of oil equivalent (Mtoe) today to 750 Mtoe in 2050”.

EU biofuel market trend:

In the EU, biofuel consumption fell by 6.8% between 2012 and 2013.

Regarding biodiesel, EU consumption in 2011 reached around 14 billion litres and declined in 2012 and 2013, by 3 and 5%, respectively. In 2014 EU biodiesel consumption slightly increased by 4% and estimates for 2017 are more promising. While according to figures from the last GAIN Report[14], in 2015, fuel bioethanol consumption is estimated at about 5.2 billion liters and is anticipated to be about 5.1 billion liters in 2017.

These trends have to be seen in the context of regulatory uncertainty in the EU.

The growth in the biofuels market has been uneven across the European Union since 2012; consumption increased in 14 countries, but decreased in 10. Likely causes were the economic crisis, which prompted some countries to reduce their imports and/or their financial support to biofuels, and uncertainties associated with forthcoming European legislation and local priorities relating to agriculture and processing economies.

These findings underline well that biofuel projections depend first on the political framework in the EU and then on decisions implemented in each Member State. High uncertainty and low visibility as the current period limit the ability of the sector to invest and to contribute both to the fight against climate change and to assure the maintenance of agricultural land in good status and to the development of rural areas in need of growth

b) Biofuels at world level and EU trade

At world level, when considering the global liquid biofuels production, the figure below provide a general overview.

Figure 10: The biofuels in the World

Source: OECD, 2016

The EU is the largest producer of biodiesel worldwide, accounting for approximately 40% of global production. The other main biodiesel producers are the US, Argentina, Brazil, Indonesia and Malaysia. While regarding bioethanol, the US and Brazil are the main producers and exporters.

The EU accounts for more than half of world biodiesel production and consumption. Its weight is expected by the European Commission to decrease slowly. Concerning bioethanol, the EU share is about 7% of the world market. EU ethanol production capacity stabilised at around 8 billion litres. Since 2009, the EU has imported soy biodiesel and feedstock mainly from Argentina and the US, and palm oil diesel and feedstock from South East Asia. Most of the growth in palm oil imports took place in the period 2012-2016 – the period of development and implementation of EU ILUC Directive regulating the sector.

In terms of EU bioethanol, both agricultural and industrial capacity are big enough to supply current and greater EU demand.

Imports of biofuels contracted following the imposition of anti-dumping duties, thus increasing the incentive for domestic production allowing EU sourced biofuels to play on a fair level playing field. The latest WTO assessment on the implementation by the EU of these anti-dumping duties must raise concerns as their abolition would result in unfair treatment detrimental to EU biofuel production. A Chatham House study suggests that palm oil consumption in the EU biodiesel sector may be much higher than previously thought, despite the Sustainability Criteria[15] listing palm oil as the least preferred feedstock for biodiesel.

Figure 11: Commodities price development, 2002 prices = 100

Source: World Bank

Nevertheless, this analysis can now be substantially reviewed as markets have evolved since then in very different ways, prices have fallen and stocks have increased. There is now more real world empirical evidence to draw upon.

Taking into account the dominant role of fossil energy in commodities markets, the low share of EU biofuels demand in farm output and analysis of agricultural markets over the last decades, biofuels produced from EU feedstock cannot be deemed to have had material impacts on the prices of EU feedstock. As demonstrated in the following parts of this analysis, biofuels are in practice a substantial factor of both stabilisation of European cereal, sugar and oilseeds markets and reduction of emission and decarbonisation of transport in Europe. Furthermore, EU feedstock based biofuels play a key role in keeping the agricultural value of lands.

In addition to this, first-generation biofuels’ production has a positive impact on EU food availability, not only do they generate additional quantities of protein rich animal feed but they can as well be switched out of the biofuel supply chain and into the food supply chain according to markets dynamics. Accordingly, the assumptions on which the debate on biofuels is based now, should be questioned objectively, since of course biofuels’ production has an impact on agricultural resources, however, the right question to address is: what is actually this impact?

2) Biofuels from an EU land, agricultural and food security perspective

The situation in the EU when dealing with the biofuels dimension cannot be compared to other major economies. There are a number of unique factors at play. The overall agricultural area of the EU is declining[16] and is expected to continue to do so (Hart et al, 2013). Farmland abandonment is a persisting phenomenon in a number of areas, especially in remote and intermediate areas, despite the compensation policy put in place since the 2000s via the Common Agricultural Policy, with tools such as Less Favored Area payments or coupled payments.

a) Biofuels, Land-use and agricultural production in the EU[17]

In the European Union, rural land accounts for 95% of the EU land area (409 Mha). Of this total area, 38% is under forest cover, 25% is cropland (of which 3% of the resulting crops are processed by biofuels producers), 20% is grassland, 5% shrub-land areas, 3% water, 2% wetland and 2% bare land[18].

Over the period 1990–2010, EU agricultural land in the EU-27 has declined by more than 1 million ha per year (15.7 Mha in total), while the forest area has grown by approximately 600.000 ha per year (9.8 Mha in total). Urban areas have continued to expand over this time, with the most reliable estimates suggesting that 100,000 hectares of agricultural land are built on every year.

When it comes to arable crops production, the area cultivated has reduced slightly since 2005. This trend continued also in the last 3 years (almost 1,5 Mha since 2013)

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

| Cereals |

57.6 |

57.8 |

58.1 |

57.5 |

57.5 |

57.5 |

57.5 |

57.5 |

57.4 |

57.3 |

57.1 |

57.0 |

56.8 |

56.7 |

| Common wheat |

23.2 |

23.4 |

24.4 |

24.2 |

24.2 |

24.1 |

24.2 |

24.2 |

24.1 |

24.1 |

24.1 |

24.1 |

24.1 |

24.1 |

| Durum wheat |

2.6 |

2.4 |

2.3 |

2.4 |

2.4 |

2.4 |

2.4 |

2.4 |

2.4 |

2.4 |

2.4 |

2.4 |

2.4 |

2.4 |

| Barley |

12.5 |

12.7 |

12.4 |

12.3 |

12.3 |

12.3 |

12.2 |

12.2 |

12.2 |

12.2 |

12.1 |

12.1 |

12.1 |

12.1 |

| Maize |

9.9 |

9.7 |

9.6 |

9.3 |

9.5 |

9.6 |

9.6 |

9.7 |

9.7 |

9.7 |

9.6 |

9.5 |

9.4 |

9.4 |

| Rye |

2.4 |

2.6 |

2.1 |

2.2 |

2.4 |

2.3 |

2.3 |

2.3 |

2.3 |

2.3 |

2.3 |

2.3 |

2.3 |

2.3 |

| Other cereals |

7.0 |

7.0 |

7.3 |

7.1 |

6.8 |

6.8 |

6.7 |

6.7 |

6.6 |

6.6 |

6.5 |

6.5 |

6.4 |

6.4 |

| Rice |

0.5 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

| Oilseeds |

10.9 |

11.7 |

11.5 |

11.4 |

11.4 |

11.3 |

11.3 |

11.3 |

11.2 |

11.2 |

11.1 |

11.1 |

11.0 |

11.0 |

| Rapeseed |

6.2 |

6.7 |

6.7 |

6.4 |

6.4 |

6.4 |

6.4 |

6.3 |

6.3 |

6.3 |

6.3 |

6.2 |

6.2 |

6.2 |

| Sunseed |

4.2 |

4.6 |

4.2 |

4.2 |

4.2 |

4.1 |

4.1 |

4.1 |

4.1 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

| Soyabeans |

0.4 |

0.5 |

0.6 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

| Sugar beet |

1.7 |

1.6 |

1.6 |

1.4 |

1.6 |

1.6 |

1.5 |

1.5 |

1.5 |

1.5 |

1.5 |

1.5 |

1.5 |

1.5 |

| Roots and tubers |

1.8 |

1.7 |

1.7 |

1.6 |

1.6 |

1.5 |

1.5 |

1.4 |

1.4 |

1.4 |

1.3 |

1.3 |

1.3 |

1.2 |

| Protein crops |

0.9 |

0.8 |

0.9 |

1.2 |

1.2 |

1.2 |

1.3 |

1.3 |

1.3 |

1.3 |

1.4 |

1.4 |

1.4 |

1.5 |

| other arable crops |

4.2 |

4.4 |

3.8 |

4.4 |

4.0 |

3.9 |

3.7 |

3.6 |

3.4 |

3.4 |

3.4 |

3.3 |

3.3 |

3.2 |

| Fodder (green maize, temp. grassland etc.) |

21.3 |

21.8 |

20.8 |

20.5 |

20.6 |

20.6 |

20.7 |

20.8 |

20.9 |

21.0 |

21.1 |

21.2 |

21.3 |

21.4 |

| Utilised arable area |

98.7 |

100.4 |

98.8 |

98.5 |

98.3 |

98.1 |

97.9 |

97.8 |

97.6 |

97.4 |

97.3 |

97.1 |

96.9 |

96.8 |

| set-aside and fallow land |

7.3 |

6.9 |

7.1 |

7.3 |

7.2 |

7.1 |

7.0 |

6.9 |

6.8 |

6.7 |

6.7 |

6.6 |

6.5 |

6.4 |

| Share of fallow land |

7.4% |

6.8% |

7.2% |

7.4% |

7.3% |

7.2% |

7.1% |

7.1% |

7.0% |

6.9% |

6.8% |

6.8% |

6.7% |

6.6% |

| Total arable area |

106.2 |

107.0 |

106.0 |

105.7 |

105.5 |

105.2 |

104.9 |

104.7 |

104.4 |

104.2 |

103.9 |

103.7 |

103.4 |

103.2 |

| Permanent grassland |

58.4 |

58.3 |

57.7 |

57.5 |

57.2 |

56.8 |

56.5 |

56.2 |

56.0 |

55.7 |

55.5 |

55.2 |

55.1 |

54.9 |

| Share of permanent grassland in UAA |

33.1% |

33.0% |

33.0% |

32.9% |

32.9% |

32.8% |

32.7% |

32.7% |

32.6% |

32.6% |

32.5% |

32.5% |

32.5% |

32.5% |

| Orchards and others |

11.9 |

11.5 |

11.5 |

11.4 |

11.4 |

11.3 |

11.3 |

11.2 |

11.2 |

11.1 |

11.1 |

11.0 |

11.0 |

10.9 |

| Total utilised agricultural area |

176.5 |

176.8 |

175.2 |

174.6 |

174.0 |

173.3 |

172.7 |

172.1 |

171.5 |

171.0 |

170.4 |

169.9 |

169.5 |

169.0 |

Figure 12: Area under arable crops in the EU, 2012-2025 (million ha)

Source: data obtained from DG AGRI, European Commission

Areas in cereals cultivation have decreased on average by 1 Mha since 2009, while the specific area dedicated to maize has remained stable in the last years, while the area on soft wheat has increased by around 1Mha (between 2009 and 2015) balancing the decrease of the barley lands.

Oilseeds remain relatively stable with the decrease of the sunflower area being compensated by an increase in rapeseed hectares.

Since 2010, the area in sugar beet cultivation has remained stable, following a loss of 100 000 ha in 2010. Nevertheless, as a whole, around 800 000 ha of sugar beet for sugar purpose disappeared between 2005 and 2010. Specifically, 150 000 ha were switched to sugar beet for ethanol purpose limiting somewhat the loss.

EU cereals production

Figure 13: Total cereals balance sheet in the EU, 2005-2025 (million tonnes)

Source: data obtained from DG AGRI, European Commission

Following a short crop in the summer of 2007, cereals experienced two good harvests: both in 2008/2009 and in 2009/2010 with around 300 mio t. As shown in the Table above, the market for arable crops has been marked by several consecutive years of record supply (especially from 2013)[19].

EU cereals production is expected to grow further, to around 314 million t by 2020, despite the problems faced in some EU regions in 2016. Domestic consumption these last years stood on average at around 280 mio t, (more than 60% represented by animal feed).

As the Table above shows, around 8 mio t of cereals were processed in 2009 for bio-ethanol (2.7% of cereal production) and protein meals, half of which was accounted for soft wheat. Later on, domestic consumption grew over the medium term, mainly driven by the rapid growth in bioethanol use.

What appears quite clearly is that production of biofuels complements food demand: the increased production of bioethanol had no impact on the availability of cereals for human or animal feed consumption) but instead, production of biofuels is vital for the animal feed co-production.

EU wheat production

Figure 14: Total wheat balance sheet in the EU, 2005-2025 (million tonnes)

Source: data obtained from DG AGRI, European Commission

U wheat production has increased over the years, despite the decreases in 2010 and in 2012. Furthermore, the drop in 2016, contradicted previous estimates. Specifically, EU soft wheat 2016/2017 estimates point to output of 135.3 Mt.

Overall areas in cereals have decreased on average by 1 Mha since 2005. While the specific area dedicated to wheat has remained quite stable, the area for soft wheat has increased by around 800 000 ha since 2013 (see Table 14 above).

Common wheat, which represents around 45% of total cereal production, is projected to reach 143 mio t by 2020. It should be noted that domestic wheat consumption is almost equally spread between feed and food uses. Wheat and maize transformed into ethanol also provide DDGS protein feed (1/3 of the amount of grains on average).

EU maize production

Figure 15: Maize balance sheet in the EU, 2005-2025 (million tonnes)

Source: data obtained from DG AGRI, European Commission

Using a stable land area, the European maize production has managed to grow by 12% (7.3 Mt) between 2009 and 2016, 2/3 of the growth in production coming from the EU12 Member States.

During this period, the EU production has experienced increased competition from imported maize (the Ukraine notably), putting pressure on the European maize sector in terms of prices. Facing such competition, the European sector has been able to maintain its area and invest in productivity mainly thanks to the ethanol sector, which sources locally grown maize.

Without this new intra-EU demand, a net drop of European maize production would likely have been experienced, in particular in areas facing deficit of competitiveness and remoteness principally in the EU12.

The latest estimates of the EU maize harvest show a significant decrease compared to the prospects from the summer. 2016/2017 estimates point to 59.9 Mt[20] instead of the levels forecasted of 67.3 Mt. Adverse climate conditions throughout the months of May and June this year, as indicated in the Short Term Outlook for EU arable crops, dairy and meat markets – Autumn 2016[21] had a significant impact both on cereal yields and quality.

EU sugar beet production

Figure 16: Total sugar balance sheet in the EU, 2005-2025 (million tonnes)

Source: data obtained from DG AGRI, European Commission

Taking into account the objectives of the reform of the European sugar policy in 2006, the decision taken by the EU to open more its market to imports of sugar from LDCs, and the EU commitment to the WTO to limit its exports to world markets (following WTO panel), the limit of the loss of sugar beet areas in the EU and the correlative safeguard of rural economies in the sugar beet regions have resulted from the development of the production of more sugar beet bioethanol.

Despite 150 000 ha having been “converted” in sugar beet for ethanol, the net balance is a strong decrease of sugar beet area in the EU from 2,3 Mha (2003-2005) to 1,6 Mha now.

Sugar beet productivity has increased markedly in recent years; 4% more sugar beets are now produced per hectare. As internal production of processed sugar has dropped over the period between 2009 and 2010 (minus 11 MT)[22] and exports have had to slow down, European production of ethanol has expanded by 70 % without any impact on European or world food security, but allowing the maintenance of jobs, added value and rural activities and land in good agricultural status in the concerned regions over Europe.

Oilseeds production

Figure 17: Production and harvest of oilseeds in the EU27, 2000-2014

Source: data obtained from FAO data

Figure 18: Total oilseed (grains and beans) market balance in the EU, 2005-2025 (million tonnes)

Source: data obtained from DG AGRI, European Commission

EU oilseed production, after the relatively low 2010 and 2012 harvests with 28.8 mio t and 27.3 mio t respectively, is recovering over the medium term and is expected to reach just over 30 mio t by 2020. Rapeseed, which is the most important oilseed grown in the EU with 63% of oilseed area, is projected to increase by 16% (DG AGRI data).

It is relevant to note that vegetable oil is mainly used in the food industry and to produce biodiesel. Oilseed meals are an important protein-rich animal feed ingredient that the EU has to import massively to answer demands of its livestock sector. In the EU context, oilseed demand specifically is mostly driven by feed use and the oilseed meal demand of EU markets.

The targets set out in the Renewable Energy Directive for the mandatory use of biofuels in the EU by 2020, these have encouraged the use of vegetable oils in the EU, and as a result of this, domestic oilseed production has grown in recent years.

In recent years the use of waste (or faux waste) oils (used cooking oils and tallow) has increased, because biodiesel produced from waste oils benefits from double counting under the Renewable Energy and ILUC Directives. This is despite concerns that UCO from outside EU cannot be considered as automatically free of ILUC impacts, since much waste oil may be imported “non-waste” leading to the potential for quite substantial negative ILUC effects.

Rapeseed production

Biodiesel produced locally using European feedstocks relies primarily on rapeseed. In the European Union, France, Germany, the UK, the Czech Republic and Poland are the main producers.

Figure 19: Rapeseed oil production in EU27, 1999-2013

Source: data obtained from FAO data

As the Figure above shows, since 2000, rapeseed production in the EU has increased substantially. As also FAOstat estimates confirm, European rapeseed oil production has almost doubled from 2000 to 2010, an increase of 4.4 million tonnes. This has been allowed by the accelerating introduction of biodiesel in the same period.

In particular, over the past decade, domestic oilseed production has been characterised by a large expansion of the rapeseed area, which is due mainly to biodiesel demand, and also by demand for protein meal.

Summary of the main findings concerning biofuels and agricultural production in the EU

Biofuels development in the EU over the last decade has occurred in a context of a general decrease of the total European agricultural area.

Considering the decisions taken formally by the EU on CAP and trade policy, the European production of biofuels (equally for locally sourced bioethanol and biodiesel) and its development has had no negative impact on supply available either for the European or the world food markets.

In fact, the development of European wheat, maize and beet based bioethanol and of European rapeseed biofuel has generated the production of by-products for the livestock sector allowing the EU to substantially reduce its dependence on imports of feed meals (soya notably) and increasing correspondingly the availability of agricultural products on the world markets as developed in the next section of this report.

Considering the European rural economy, the development of European sourced biofuels has been the single most immediate, available, efficient and concrete answer to the challenges underlined at the European level by the three main European institutions, i.e.

- Maintenance of agricultural lands in good agricultural status: requirement to farmers defined in the CAP (cross compliance requirements) based on environment and global European food security concerns;

- Development of growth and jobs in rural areas in a context of market volatility. European sourced biofuels production has been the main incentive for development of agricultural production and limitation of shrinkage of agricultural areas in the EU. In addition, European sourced biofuels are produced mostly in EU intermediate and less favoured areas, generating activities and avoiding decrease of agricultural production and thus related collapse of rural activities.

- Decarbonisation of transport as first generation biofuels are the main (and nearly the only) available answer today and in the forthcoming years.

Finally, it is important to reiterate that global biofuel demand can hold at current levels, and could also grow.

A balanced development of the biofuels industry has the capacity to provide a stable demand for EU agriculture in areas, where productivity gaps are present. Along with this, it could respond at the same time to the sustainability expectations of society. Developing synergies between EU sustainable biofuels with agricultural production, could represent a way to counterbalance agricultural markets risks, while contributing to climate change adaptation and mitigation efforts.

In particular, the cultivation of crop-based feedstock for biofuels, notably on marginal lands, should be promoted as a way to minimise the risk of loss of agricultural land in the EU while increasing European and global food security thanks to co-production of extra rich protein meals.

Furthermore, utilising agricultural land in this way, would create an additional and most importantly, a stable income source for hundreds of thousands of European farmers.

However, from a more global point of view, issues and concerns related to UCO (Used Cooking Oil) of which a growing part is being imported should be tackled properly, since UCO outside the EU is generally not a waste and is used for both feed and fuel. Its preferential use in Europe as a non-feed “waste” is thus highly questionable.

b) European sourced biofuels and food security

European sourced rapeseed biodiesel

Biodiesel production based on European rapeseed has built its development on the increase of EU rapeseed production, while EU oilseeds area has remained quite stable (see Table A11 in Annex).

As a result and concerning rapeseed protein meal, the production has doubled between 2004 and today. Specifically, 9.3 million tons of rapeseed meal are directly attributable to EU biodiesel production[23]. While the rapeseed oil is used to produce biodiesel, its by-product protein is available as a new supply for the EU livestock sector.

This increase of availability of vegetable protein in the EU has consequently a direct impact on the production of feed materials for use as animal feeds, thus reducing their imports. As a matter of fact, Europe has a structural protein deficiency and is 70% dependent on imports of protein crops and meals from third countries. A recent report developed by the European Parliament estimates that the deficiency of protein crops in the EU amounts to 20 million tonnes[24].

In this context, the European Parliament, as well as Member states, “calls on the Commission swiftly to submit to Parliament and to the Council a report on the possibilities and options for increasing domestic protein crop production in the EU by means of new policy instruments (also taking into account the use of oil seeds and their by-products and the potential extent for substituting imports), the potential effect on farmers’ revenues, the contribution it would make to climate change mitigation, the effect on biodiversity and soil fertility, and the potential for reducing the necessary external input of mineral fertilisers and pesticides”

Europe is still dependent for 70% of soybean meal imports to meet its growing livestock demand. The development of the output of rapeseed and sunflower meal (protein meal account for about 60% of the seed and oil 40%) has ensured a minimum of self-sufficiency. Soybean meal imports declined, especially from 2007 peak level, as a result of increased vegetable protein meal production within the EU which allowed to avoid imports each year of nearly 10 million tonnes of rich protein meal, reducing the EU deficiency by one third.

While food consumption of rapeseed oil has been steady for decades, and oilseed output is also unchanged from 30 years ago, the development of an increasing European supply of protein meal has been made possible by finding alternative outlets for oil.

It is evident therefore that feed meal production, biofuel production from European vegetable oils and cereals are key (and today the only quantitative option) for improving and securing the availability of higher volumes of vegetable protein produced locally and used as animal feed source, limiting imports. The EU biofuels industry processing rapeseed and cereals now produces approximately 13 million tons annually of high protein meals that otherwise would be imported from the Americas. It should be underscored that every liter of biodiesel produced from palm oil or UCO instead of from rapeseed means a lost kilogram of EU protein meal production.

In that respect, Europe should have the ability to produce enough feed proteins and to reduce drastically the reliance on imported feed materials. On this sensitive issue of EU protein self-sufficiency, increasing European conventional biofuels to around 15% of EU transport sector energy by 2030 would actually mean cutting in half the European deficit of high protein meals.

European sourced bioethanol

For every tonne of cereals used by the industry as much animal feed is produced as ethanol. In 2014 bioethanol companies produced 5.2 million tonnes of co-products, of which 63% was highly valuable animal feed. This 3.3 million tonnes of animal feed was enough protein to feed 2.1 million dairy cows, 10% of the EU dairy herd. On average, 2.7 kg of grain produces 1 litre of ethanol and 1 kg of protein-rich animal feed.

The same applies for sugar beet. When 10 kg of sugar beet containing 16% of sugar results in 1 litre of ethanol, 600 grams of a co-product, the so-called vinasse is produced and 550 grams of dry malter or sugar pulp. Vinasse can be used as a rich non-mineral based fertiliser, animal feed or a source of biogas production, whereas, pulp can be used for animal feed or biogas production.

Through the added value of domestically co-produced ethanol and animal feed, 1 hectare of sugar beet or wheat cultivated for EU ethanol production can free up to 1.3 hectares of arable land globally, mostly in third countries. This has the hugely positive consequence of limiting deforestation across the globe.

In addition, it has to be noted that the EU’s ethanol biorefineries are the most advanced in the world in terms of co-products, producing an expanding array of high value bioeconomy products every year. Whereas in 2009, the most advanced ethanol biorefineries in Europe produced only animal feed and ethanol, today they produce ethanol, animal feed, vegetable oil, nutraceutical products, various products for human food, bio-electricity, fertilizer and other products.

Summary of the main findings related to biofuels and food security supply

As stated previously, the development of European wheat, maize and beet based bioethanol and of European rapeseed biofuel results in the production of substantial valuable co-products being to the European livestock sectors.

12,6 Mt of animal feed co-product[25] has allowed reducing equivalent imports of feed meals (soya notably) and it has had a corresponding positive impact on the available resources of agricultural products on the world markets for food and feed consumption.

All the arguments stated above should amply answer the food security concerns related to conventional biofuels production within the European Union.

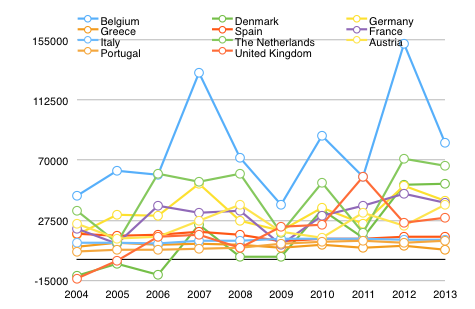

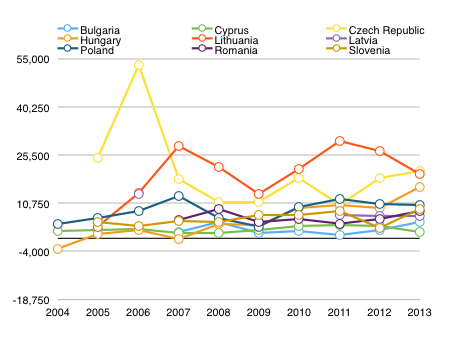

c) Biofuels and agricultural price volatility

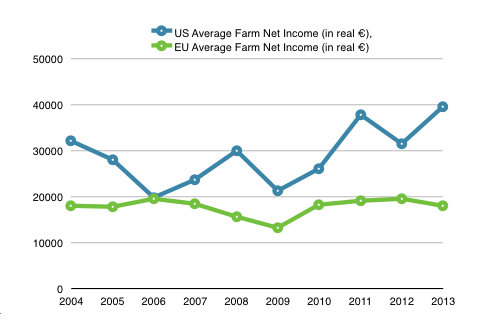

In 2008, the soaring prices of agricultural markets – in the wake of oil and other raw materials concerned – led to large price volatility (see Figure below).

Until 2008 biofuels were presented by the media and the public authorities as the solution to energy problems, and actors in agribusiness were regularly blamed for their delay in making the necessary investments.

During the rise of the food prices, the rising demand of biofuels was pointed to by some experts as well as organisations as one of the main causes.

However, FAO’s HLPE (2013)[26] study determined that many factors caused the steep rise in food prices, such as: the impact of high oil prices on agricultural fuel and input costs, rising food demand, combined with a shift to animal protein diets in the large emerging economies, the influence of China ́s cereal stock management, weather events in major exporting countries, a slowdown in agricultural productivity growth, and speculation. In addition, the impact of biofuels on commodity prices may be considered as too low to quantify, as determined recently by the World Bank’s leading expert on the issue[27].

Figure 20: Commodity Prices trend 1992-2016

Source: IndexMundi, FAO data

Agricultural commodities make only a small proportion of the overall production costs of processed foods[28]. Price volatility in agricultural markets is mainly influenced by higher transportation costs, high inputs costs and the cost of energy, among the others, as stated by Von Witzke and Noleppa study.

In particular, considering EU production of biofuels, it has had almost no impact on the evolution of prices of basic agricultural commodities as price developments were primarily correlated to changes in world prices. On the contrary, the damping effect of the biofuels sector and its benefit in animal feed are recognised. Related to this point the European Parliament in its last briefing on EU biofuels policy (January 2015) explains that the possible impact of developed countries’ biofuels policies on global food prices became a significant concern in 2007, when global grain prices reached historic heights. “Though some experts associated the unprecedented price spikes in food grain and oilseed with these countries’ biofuels policies[29], most of them now agree that these policies are unlikely to have been the main culprit, although they may have been a factor”. Particularly, the European Parliament estimates that the impact of EU biofuels demand from 2000 until 2010 has increased world grain prices by about 1-2% and oilseed prices by around 4%. An EC report on biofuels (by Ecofys) released in 2014 confirms the 2% figure.

Concerning global ethanol, production increased by 45% between 2008 and 2015, while commodities prices dropped. In the US, for instance, the price of corn is now lower than in 2007, while the tons processed into bioethanol increased by 70% between 2007 and 2014.

This does not mean that biofuels have no impact on food prices, but a direct causation between the factors cannot be established. The debate in this regard, should be shifted from simplistic patterns to a more objective basis.

At the end of 2015 the problematic and volatile conditions seemed to have returned: a slowdown in global growth, a sharp fall in oil prices, and agricultural markets facing a general decline. All products were affected and farm incomes fell sharply worldwide.

This was amplified in Europe by elements affecting the livestock sector following the abolition of milk quotas and the Russian embargo on imports of pork and poultry, as well as the production of major crops (cereals, oilseeds, sugar) which were also struggling.

In this context, European sourced biofuels help in limiting the adverse effects of the food markets U-turn, offering some economic stability.

At world level and for the next decades, the FAO estimates:

- Population will grow from 7.5 Billion today to more than 9 Billion by 2050

- A 60% to 70% increase in agricultural production is required by 2050. This takes into account the needs arising from changing diets in countries in transition, and the production of energy crops. The FAO considers that this increased production is possible, while respecting the environment: the increase will come from 80% improvement in yields, or cropping intensity (number of crops per year) and 20% of new land into production. This is basically a continuation of the evolution that led from 1950 to nowadays to feed a population that increased from 3 to 7.5 billion humans

- The world has the means to feed itself, while continuing to devote a portion of land resources in the production of agricultural products for industrial use, notably biofuel

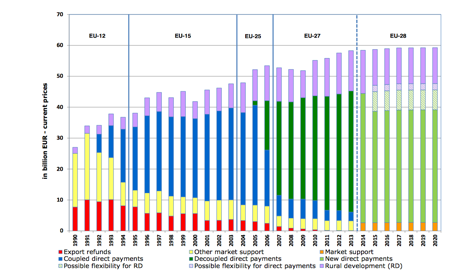

3) European regulations on Biofuels

The European Union established a biofuels support policy in 2003 with the aim of lowering CO2 emissions in the transport sector. In this way, varying objectives were expected to be achieved:

- tackling climate change impacts;

- securing energy supply; and

- diversifying energy sources.

The Common Agricultural Policy (CAP)[30] has been one of the main levers used to support the development of biofuels within the EU. Beginning in 1992, the establishment of compulsory set-aside lands to counter overproduction in food markets allowed for the production of non-food crops. In 2004 an energy crop support of 45€ per hectare was introduced. After a few years, in 2009, with the CAP Health Check and the so-called “market orientation”, EU direct support for the biofuels industry via the CAP declined: the energy crops premium of EUR45 per hectare[31] and compulsory set-aside of lands were abolished.

On April 23, 2009 the European Union adopted the Renewable Energy Directive (RED)[32] which establishes an overall policy for the production and promotion of energy from renewable sources in the EU. It requires the EU to fulfil at least 20% of its total energy needs with renewables by 2020 – to be achieved through the attainment of individual national targets. All EU countries must also ensure that at least 10% of their transport sector energy comes from renewable sources, such as biofuels, biogas, renewable electricity or other renewable sources by 2020.

|

2005 (Mtoe) |

2010 (Mtoe) |

2015 (Mtoe) |

2020 (Mtoe) |

Share (%) |

| Bioethanol/bio-ETBE |

0.5 |

2.9 |

5.0 |

7.3 |

22.2% |

| Biodiesel |

2.4 |

11.0 |

14.5 |

21.6 |

65.9% |

| Renewable electricity |

1.1 |

1.3 |

2.0 |

3.1 |

9,5% |

| Other biofuels |

0.2 |

0.2 |

0.3 |

0.8 |

2.4% |

| Total renewable transport |

4.2 |

15.4 |

21.8 |

32.8 |

100.0% |

Biofuel targets to 2020 have been set by each Individual EU Member State plans are outlined in the respective National Renewable Energy Action Plan[33]. Table below shows the contribution of the renewable transport energy carriers in the EU:

Figure 21: Total renewable transport (RES-T) energy for all 27 EU Member States

Source: ECN

Specifically, the data shows that biofuels will continue to make up over 90% (around 28.9 MTOE) of renewable energy demand in 2020, with the remaining 3.1 Mt being met by renewable electricity[34].

Biofuels in the EU must conform to strict sustainability criteria[35] to ensure that their production and use do not cause any harm to the environment or negative social effects. Accordingly, the Renewable Energy Directive, which was adopted in 2009, sets out biofuels sustainability criteria for all biofuels consumed in the EU.

These criteria include a minimum rate of direct GHG emission savings (35% in comparison to fossil fuels, in 2009 and rising to 50% in 2018) and restrictions on the types of land that may be converted to production of biofuels feedstock crops. The latter criterion covers direct land use changes only. Specifically, biofuels cannot be grown in areas converted from land with previously high carbon stock such as wetlands or forests and also they cannot be produced from raw materials obtained from land with high biodiversity such as primary forests or highly biodiverse grasslands[36].

The revised Fuel Quality Directive (FQD), adopted at the same time as the RED, includes identical sustainability criteria and targets a reduction in lifecycle greenhouse gas emissions from transport fuels consumed in the EU by 6% by 2020[37].

It is very important to note that actual GHG saving values currently being certified and calculated with RED methodology are far exceeding both the typical and the default values published in the RED.

In addition to this framework, the Parliament and Council asked the Commission to examine the question of indirect land use change (ILUC), including possible measures to avoid it, and report back on this issue by the end of 2010[38]. Following this invitation, the Commission adopted a Communication on 22 December 2010[39] summarising the consultations and analytical work conducted on this topic since 2008. In this report, the Commission put investors on notice that it had identified and would choose one of four potential responses to ILUC given the state of information available, namely (i) do nothing, (ii) apply an “ILUC factor”, (iii) increase the GHG savings requirement for all biofuels, or (iv) develop a diplomatic approach to tackle peatland conversion in Indonesia and Malaysia for palm oil, which was the overwhelming source of ILUC emissions.

There are two ways in which an increase in biofuel consumption may lead to cropland expansion and so to Land Use Change: directly (DLUC), when new cropland is created specifically for the production of feedstocks for biofuels, or indirectly (ILUC), when already existing cropland is used to produce biofuels feedstock, leading to a displacement of whatever demand was there previously to croplands elsewhere in the world. Direct land use change is addressed in the existing sustainability criteria while indirect land use change – ILUC is not.

On October 17, 2012, the Commission released a proposal[40], which introduced significant changes to the existing European Union biofuel policy under the Renewable Energy Directive (RED). By basing its proposal on none of the policy options of the 2010 Communication, the Commission chose instead to change the approach and to cap conventional biofuels at 5% of transport sector energy, using IFPRI’s report on ILUC[41] to justify the concept.

However, it is worth looking through the details of the IFPRI report. By its terms, it was only applicable to a minority of biofuels volumes in the EU whereas the Commission used it extensively, by generalised application to all biofuels. The report acknowledges that locally sourced biofuels show low levels of ILUC.

Analysing in depth either the IFPRI or the Globiom report, the rational of the Commission’s proposal to limit conventional biofuels can be questioned and its secure scientific footing too.

It has as well to be questioned due to the fact that:

- there is no scientific analysis that says anything about an “ILUC factor” applicable to all crop based biofuels;

- the 2015 ILUC directive foresees to pursue ILUC mitigation strategies

- ILUC is an issue that affects not only crop-based biofuels but both wheat straw ethanol (depending on how it is produced) and UCO-based biofuels which can have much higher ILUC impacts than any biofuel produced from EU crops.

At the end of the day, it seems that the position taken by the Commission continues first and foremost to be based on the assumptions of nearly a decade ago concerning land grabs and “food versus fuel”, without analysing or taking into consideration the specific European case, the many recent and available scientific reports and ten years more of real world empirical evidence.

In April 2015, the European Parliament gave approval to an amendment that states that crop-based biofuels should not exceed 7% of transport sector energy by 2020 while establishing a target of 0.5% for advanced biofuels coming from so called “non-food” sources. This specific amendment and the Commission’s original proposal pushed back as well the 50% threshold from 2017 to 2018, which was contradicting the ambitions for the climate.

Member States must include the law in national legislation by 2017, and indicate how they expect to meet sub-targets for advanced biofuels.

The contribution of first-generation biofuels (to the 10% renewables in transport target) is capped at 7%, whereas the other 3% will come from a variety of alternatives:

- Renewable electricity in rail (counted 2.5 times)

- Renewable electricity in electric vehicles (counted 5 times)

- Advanced biofuels (double counted and with an indicative 0.5% sub-target)

- Biofuels from Used Cooking Oil[42] and Animal Fats (double counted)

Finally, the European Commission tabled its ‘Strategy for a European Low-Emission Mobility[43]’ on 20 July 2016, in which it outlines policy options, which may contribute to its 20% transport emission reduction target in the context of the 2030 Climate Package.

In the Strategy it is stated that “food-based biofuels have a limited role in decarbonising the transport sector and should not receive public support after 2020”. The accompanying Staff Working Document proposes scenarios (BIO-A, BIO-B) envisaging a policy landscape designed to promote a rapid decline in consumption of conventional biofuels, ”reducing the contribution that “food-based” biofuels make to the overall share in liquid and gaseous fuels to 0% in 2030”

Discussing this proposal in a debate held in October 2016 in the EP, DG Energy stressed that the basis of the proposed phase-out (or at least a sharp reduction) was first and foremost the risk of competition between food and biofuels that some NGOs are highlighting while the positive impact of biofuels on decarbonising the transport sector was not the main topic taken into account.

In other words, the Commission proposed first to eliminate the biofuels sector by 2030 and now seems willing to cut by nearly half the European production of liquid conventional biofuels, putting at stake the reduction of emissions provided by biofuels use, the hundreds of thousands of farm livelihoods that depend on them, the protein feed industry and the processing jobs.

The current direction of the EU policy on biofuels clearly undermines the potential of producing clean renewable fuel. The EC is pursuing a line towards discarding the contribution of conventional biofuels on transport decarbonisation and their potential in sustainable feedstock production.

5) ILUC compliancy

The world has now seen a considerable number of ILUC studies and two of them specifically applicable to European biofuels (IFPRI and Globiom). Over time three trends stand out in these studies: first, the more recent ones increasingly recognize the remarkable efficiency growth of current biofuels plants. This is demonstrated by the fact that most EU biofuels today already exceed 50% GHG savings, even though less than a decade ago the experts in the European Commission projected the opposite. Secondly, the “displacement” impact of biofuels is not as massive as anticipated. Thirdly, palm oil and peat lands in Southeast Asia represent almost the total source of ILUC. This last point raises the question of Indonesia’s and Malaysia’s effective efforts to halt peat land drainage and conversion.

The one consensus element, arising from all the scientific data, is the negative impact of palm oil, especially in the context of deforestation of highly diverse and carbon rich ecosystems. Use of palm oil for biodiesel in Europe has grown to over 3 million tonnes per annum contributing to the expansion of palm oil deforestation in Sumatra and Indonesia (world palm oil capacity increased from 45Mtpa to over 60Mtpa in the five year period to 2016, with EU production of palm biodiesel accounting for nearly a fifth of this growth). This issue should be tackled via a proper trade coherent action.

Considering this issue, one can only note that with the Commission’s proposal in 2012 on “crop-based biofuels”, the EU has been locked into strong levels of increasing imports of palm oil into Europe. By the time the ILUC Directive was passed, this had come reality (not only with palm oil, but also with provisions privileging de facto imported UCO over domestic UCO or rapeseed).

In this regard, it is relevant to stress that, were EU biofuel markets to have no nexus to palm oil (as also anticipated by the 2010 Commission’s Communication on policy choices and modelled in the recent GLOBIOM study on ILUC) all of European-sourced biofuels would show very substantial GHG savings even when including ILUC effects.

It looks like ILUC has been quite misunderstood.

It is through the EU Renewable Energy Directive (2009/28/EC) that the European Commission developed a methodology to account for the ILUC effect. The EC definitely had difficulties in including the ILUC dimension within the regulatory perspective of its action, since ILUC cannot be observed or measured in reality.

On March 11, 2016 a consortium comprising Ecofys, IIASA and E4tech on behalf of the European Commission published the final report of a study which assessed indirect land use change impacts of conventional and advanced biofuels consumed in the EU[45].

The study, better known as the GLOBIOM study, centres on the fact that land use change impacts and associated emissions are lower when crop production for energy takes place with minimum risk of displacement of existing farm demand, i.e. production is not driving forest or peatland conversions elsewhere.

ILUC refers to the concept of displacement, or that growth in demand in one sector can displace demand in others, causing the system to arrive at a new equilibrium by finding other sources. It applies to all economic activities.

Yet most domestic biofuels in Europe are actually ILUC free already and all will be by 2035. This is because European biofuels cause virtually no displacement. Phasing out current biofuels irrespective of their qualities will only result in replacement of today’s ILUC compliant supplies by new ‘advanced’ supplies – some ILUC free and some likely not – instead of using all ILUC free biofuels to displace fossil oil.

At this stage, what the regulators should recognise is that ILUC risk can be readily determined by assessing displacement. Measurement is not needed when it can be authoritatively demonstrated that there is little or no displacement.

Certifying displacement and ILUC compliant biofuels is a manageable objective. The processes are in place and service-ready, and the criteria are straightforward.

Set-aside land: most EU biofuels today are iLUC compliant because they never caused displacement, coming as they did from set-aside land.

Certified Low Risk: Displacement free biofuels are widely produced using crops arising from yield improvement, double cropping and land with low carbon stock, i.e. measures causing no displacement.

Minimum GHG thresholds, ILUC included: Europe’s biofuels industry now achieves certified greenhouse gas savings of well over 50% compared to oil, and is quickly improving. Biofuels sources which exceed the threshold GHG requirements, ILUC factor included, should also be supported.

What the Globiom study highlights very clearly is that “one of the major contributors to LUC emissions, peat land drainage (for palm oil), is a relatively local problem. If peatland drainage in Indonesia and Malaysia were stopped, the negative greenhouse gas impact of land use change would reduce dramatically”.

Indeed palm oil now accounts for 45% of European biodiesel and European biodiesel accounts for 5% of world palm oil and 15% of palm oil growth. Stopping palm oil use in biodiesel will help reduce peatland conversion.

The EC’s Globiom study also introduces the concept of avoided afforestation (foregone sequestration) in the case of arable lands kept in production as a result of demand for biofuel. However, this has to be seen taking into account the CAP requirement of maintenance of agricultural lands in good agricultural status.

The GLOBIOM study is not the first one that quantifies land use change impacts of EU biofuels. It follows previous studies published by the US based International Food Policy Research Institute (IFPRI) in 2011[46] (Laborde, 2011).

This study focused on specific feedstock Land Use Change (LUC) computation and the uncertainties surrounding these values. It has been highlighted also there, that there is a lack of data on the impact of the direct greenhouse gas savings thresholds on biofuel markets and LUC. However, the study shows that the direct savings thresholds will ensure that all biofuels used in the EU in 2020 have at least 50% direct greenhouse gas emissions savings.

It is also worth mentioning a report[47], compiled by a team of experts from 10 institutions, that outlines a number of ways in which development-focused efforts to promote food security and secure clean and reliable sources of energy for local populations can align in a synergistic way. Furthermore, a new recent study by IFPRI (June 2016) also suggests that the impacts on food security of policies to encourage bioenergy production may be “strongly positive, if properly designed. helping to attract investment in the agriculture sorely lacking in most developing countries.“ The report also stresses that food and bioenergy are not necessarily in competition for land, and that ” land is not, in most cases, the critical factor affecting food security.”[48]

By applying the principles of “displacement assessment” (on which ILUC modeling is based) rather than the precautionary principle stakeholders can readily arrive at effective policies for promoting sustainable low ILUC biofuels and avoidance of damaging land use change.

Regarding EU biofuels it is important to highlight that no land use change has been brought about in Europe by domestic biofuels crops but rather an overall increase in land conservation. It is also worth noting that there has been a decrease of agricultural land in the EU, which was due to urbanisation and land abandonment. The main challenge is to avoid heading to more urbanisation and to “fallow” land, which is bad both for environment and for biodiversity.

In particular, it is relevant to bear in mind that, if EU farmers can not longer grow for the biofuels market they will consequently be forced to leave the land fallow and this will have an impact on investments and yields improvement.

Accordingly, by taking these facts, the current European biofuels sector – where imports are excluded – is to be preserved.

With reference to the debate about indirect land use change, rapeseed is almost always misrepresented. Studies on ILUC assume rapeseed displaces some other use of agricultural land. However, most EU rapeseed production did not replace the growing of another crop, but rather the practice of leaving fields fallow.

Under all ILUC science, there is no ILUC from a crop grown without displacing another crop. This is the case of most rapeseed biodiesel in the EU today, not mentioning the fact that EU grown rapeseed biodiesel generate co-products which limit the need of high protein feed to be imported. Consequently, it allows the release of agricultural areas in third countries for other food purpose and thus contribute to increase the global food security. This should be seen as ILUC « credits ».

The same is true when it comes to EU bioethanol produced from EU feedstocks.

As EPRS notes in a 2015 report on the EU biofuels policy[49], in the EU arable land has been falling out of agricultural use and is expected to continue to do so. It is also stated that according to the European Commission, “the main effects of biofuel consumption on EU land use have been a reduced rate of land abandonment” in coherence with the EU requirement if maintaining arable lands in good agricultural status.

“Agricultural land in the EU has seen a slight reduction over time – in general, because of the spread of forests and other habitats, and greater urbanisation. This trend is expected to continue, though at a slower rate, bringing utilised agricultural area to 173.1 million ha by 2024”[50].

In addition to this, despite the increased demand for agricultural raw materials from biofuels in the recent years, there are still over 1.7 million hectares of uncultivated arable land available within the EU. Accordingly, they came to the conclusion that Europe is capable of supplying agricultural raw materials for various markets, without jeopardising the availability of food. There is still a lot of potential. Furthermore, 7.4 million hectares of agricultural land were recorded as fallow in 2012[51].

6) Conclusion

Today, around 13 Mtoe of European feedstock sourced biofuels are produced for the European market, which also produce 12,6 million tonnes of rich feed materials supplied to livestock industries for food production. They are all produced without farming new land, but on the contrary while contributing to the objective of maintenance of rural economy (notably in economically most sensitive EU regions) and arable lands in good agricultural status.

This production of domestic biofuels has not only not displaced any supply of food or feed markets either internally, and nor on world markets if the generalised palm oil expansion is stopped, but they have induced the production of substantial extra quantities of protein feed materials allowing the EU to greatly reduce its imports of soy meals. It is relevant to note in this regard, that also the European Parliament in a recent report, highlighted that the EU protein crops and meal deficiency still amounts to 20 million tonnes.

Consequently, it emerges that not only should the vast majority of European feedstock sourced biofuels currently produced in the EU be recognized (in full alignment of best available science) as having no or low ILUC impact for 2030 and beyond, but formally they should get attached to their production an ILUC credit as each produced ton of these biofuels results in less need for feed imports, thus less pressure on countries where tropical deforestation is a major concern.

EU sourced biofuels, by bringing much needed domestic feed meals for the EU livestock sector, and contributing to the reduction of the 70% protein deficit of the EU, should clearly get differentiated treatment and incentive in the Regulation.

As stated before, most EU biofuels never had ILUC risk (production on set-aside land, cereals/beet from yield increases, use of marginal land) and in addition to this it is necessary to recall that, by 2030 nearly all current biofuels capacity in the EU will be completely free of ILUC risk.

Domestic biofuels provide great benefits both for the climate and economy, while not posing any risk of distorting supply and demand dynamics in undesirable ways.

In addition to climate benefits, the 30 million tonnes annually of sustainable and ILUC compliant domestic European cereals, beet and oil seed bring 5 billion euros of income to the farm sector, long term income security to several hundred thousand farm families and high quality non-farm jobs to many people in processing industries.

The refineries act as anchors and hubs for bioeconomy innovation and assure an investment community available for industrialisation of advanced bioeconomy technologies.

The development of new EU biofuels capacity should be managed responsibly through ILUC sustainability criteria. European biofuels will be in a position to be developed under the following conditions:

- produced from European feedstock;

- having no impact on European cereal and oilseeds availability to the traditional food and feed markets of the EU.

- not inducing extra imports of feedstock

Today the EU is a net importer of biofuels. Well informed decisions to promote balanced and locally sourced biofuels in the EU will mean that for every additional production of locally sourced biofuels, there would be a corresponding decrease in farming biofuels in third countries with uncertain sustainability practices. There will be a decrease in feedstocks produced in third countries to be exported to the EU to produce biofuels and a decrease of feed meals imported in the EU from third countries. Moreover, those third countries could use the freed-up land resources for afforestation and food security purposes.

Regarding palm oil concerns, with the 2012 Commission’s proposal on “crop-based biofuels”, the EU has been locked into strong levels of increasing imports into Europe. Furthermore, specific provisions in the ILUC Directive has led to the highly questionable choice of imported UCO (which is generally not a waste and is used for both feed and fuel) over domestic UCO or rapeseed. However, these two topics need to be addressed differently, because while the first one should be tackled via a coherent and objective revision of the current policy framework, the issue of the negative impact of palm oil needs to be framed in the context of trade and environmental actions.

As aforementioned, were EU biofuel markets to have no nexus to palm oil, all of European-sourced biofuels would show very substantial GHG savings even when including ILUC effects.

To conclude, the implementation of an appropriate, logical, balanced but mostly objective EU biofuel policy has not only the potential to make sustainable first-generation biofuels a real and effective lever for development, but it also has the capacity to strengthen and develop further the economic, social and environmental sustainability of European sourced biofuels, making a real contribution to climate change abatement.

8) References

Allen B, Kretschmer B, Baldock, D, Menadue H, Nanni S and Tucker G (2014) Space for energy crops – assessing the potential contribution to Europe’s energy future. Report produced for BirdLife Europe, European Environmental Bureau and Transport & Environment. IEEP, London

http://www.eeb.org/EEB/?LinkServID=F6E6DA60-5056-B741-DBD250D05D441B53

Avril Group: http://www.groupeavril.com/en

Beurskens, L.W.M., Hekkenberg, M. and Vethman, P., “Renewable Energy Projections as Published in the National Renewable Energy Action Plans of the European Member States” European Environment Agency, 28 November 2011.

https://www.ecn.nl/docs/library/report/2010/e10069_summary.pdf

Colombo, B. et al., “How Does Agriculture Change Our Climate?” Environment Reports – Food Matters.

http://www.environmentreports.com/how-does-agriculture-change/?utm_campaign=faostatistics&utm_source=twitter&utm_medium=social%20media#section2

Directive 2012/0288 (COD) of the European Parliament and of the Council amending Directive 98/70/EC relating to the quality of petrol and diesel fuels and amending Directive 2009/28/EC on the promotion of the use of energy from renewable sources (Proposal). Brussels 17.10.2012.

http://ec.europa.eu/clima/policies/transport/fuel/docs/com_2012_595_en.pdf

Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the promotion of the use of energy from renewable sources and amending and subsequently repealing Directives 2001/77/EC and 2003/30/EC (Text with EEA relevance)